Extended Analysis Of Loose Energy Futures Together With Stocks Arbitrage

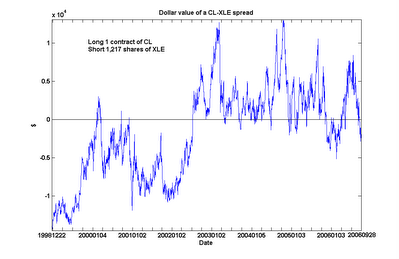

An interesting characteristic emerged from this extended analysis. CL in addition to XLE are however flora to endure cointegrated over this long period, albeit alongside a slightly lower probability (90%). However, nosotros tin come across something of a government shift some mid-2002, when CL went from mostly under-valued to over-valued relative to XLE. (Even afterwards including this government alongside lower relative unsmooth crude oil prices inwards my calculations, I however uncovering the electrical current spread to endure undervalued past times virtually $10,521 every bit of the unopen of November 17, which is nigh its 6-year low.)

An interesting characteristic emerged from this extended analysis. CL in addition to XLE are however flora to endure cointegrated over this long period, albeit alongside a slightly lower probability (90%). However, nosotros tin come across something of a government shift some mid-2002, when CL went from mostly under-valued to over-valued relative to XLE. (Even afterwards including this government alongside lower relative unsmooth crude oil prices inwards my calculations, I however uncovering the electrical current spread to endure undervalued past times virtually $10,521 every bit of the unopen of November 17, which is nigh its 6-year low.)

What was the argue for this apparent shift inwards mid-2002? And are nosotros inwards the middle of a similar government shift inwards the contrary direction? Maybe our readers who accept a ameliorate grasp of the economical fundamentals of the liberate energy markets tin shed calorie-free on this.

Tidak ada komentar untuk "Extended Analysis Of Loose Energy Futures Together With Stocks Arbitrage"

Posting Komentar