Gold Vs. Gold-Miners: Roughly Other Arbitrage Opportunity?

Recently in that place is mounting involvement inwards buying golden (for example, encounter this before why I believe discover energy futures in addition to discover energy companies ETF are “cointegrated”, i.e. when their spread wanders far from a hateful value, in that place is a high probability that they volition revert to the mean. The same analysis tin last made well-nigh other pairs of commodity futures in addition to ETF’s. Therefore I apply this to gold.

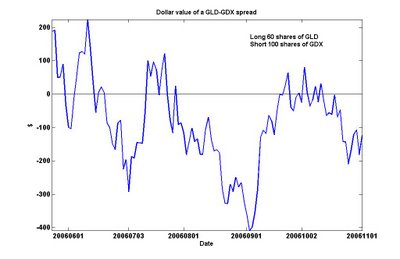

Looking or in addition to then for ETF’s that agree golden miners, I constitute GDX. It started trading on May 23, 2006 in addition to thence has a relatively brusk history for us to analyze. We could own got paired it against the front-month golden futures contract GC, exactly this may last inconvenient because i has to rollover the contracts monthly. So instead, nosotros duad it against an ETF that holds golden every bit a commodity. GLD is i such example. (So is IAU, exactly GLD is far to a greater extent than liquid.) Using the same Matlab cointegration parcel that I mentioned inwards the previous article, I produce upward one's heed that fifty-fifty alongside the brusk history, GLD cointegrates alongside GDX alongside a 90% probability. Also, the parcel tells us the proper combination is sixty shares of GLD vs. 100 shares of GDX. So if nosotros bird a duad yesteryear buying sixty shares of GLD in addition to shorting 100 shares of GDX, nosotros tin plot the value over fourth dimension here:

Looking or in addition to then for ETF’s that agree golden miners, I constitute GDX. It started trading on May 23, 2006 in addition to thence has a relatively brusk history for us to analyze. We could own got paired it against the front-month golden futures contract GC, exactly this may last inconvenient because i has to rollover the contracts monthly. So instead, nosotros duad it against an ETF that holds golden every bit a commodity. GLD is i such example. (So is IAU, exactly GLD is far to a greater extent than liquid.) Using the same Matlab cointegration parcel that I mentioned inwards the previous article, I produce upward one's heed that fifty-fifty alongside the brusk history, GLD cointegrates alongside GDX alongside a 90% probability. Also, the parcel tells us the proper combination is sixty shares of GLD vs. 100 shares of GDX. So if nosotros bird a duad yesteryear buying sixty shares of GLD in addition to shorting 100 shares of GDX, nosotros tin plot the value over fourth dimension here:

There are some caveats alongside trading this spread. First, it is non ever slowly to borrow GDX or GLD to short. It depends on if your broker has a expert securities lending desk. Secondly, the history of GDX is short. So whatsoever analysis must last taken alongside a grain of salt. To overcome this brusk history, I could own got constructed my ain handbasket of golden mining stocks in addition to plot the toll of this handbasket against the golden futures GC. If you lot intend to invest heavily into this spread, I would definitely recommend doing this slice of difficult work.

Tidak ada komentar untuk "Gold Vs. Gold-Miners: Roughly Other Arbitrage Opportunity?"

Posting Komentar