Trading A Platinum-Gold Seasonal Spread

Quantitative traders tin sometimes lose sight of the fact that many profitable trading strategies are extremely simple, requiring no math at all. Such is the representative amongst a seasonal spread merchandise betwixt platinum in addition to aureate that was profitable inwards all simply 1 of the concluding vii years. This is far to a greater extent than consistent than the seasonal spread merchandise that ruined Amaranth (see my before article).

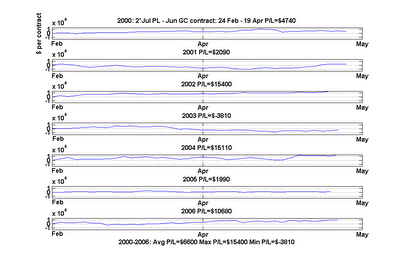

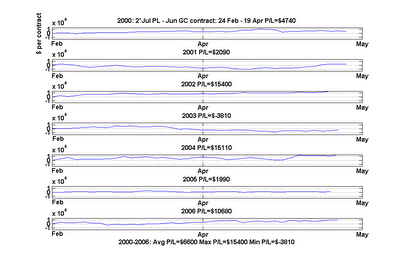

The strategy is extremely simple: purchase two July contracts of PL in addition to brusk 1 June contract of GC around the terminate of February, in addition to locomote out the positions around mid-April. (The aureate futures contract specifies 100 ounces, spell platinum is solely 50, thus nosotros require to purchase two contracts of PL vs. 1 contract of GC.) I firstly read near this strategy inwards an article yesteryear Jerry Toepke inwards the SFO Magazine inwards the showtime of 2006 in addition to I decided non solely to backtest it, simply equally good newspaper merchandise this strategy inwards 2006 to come across if it industrial plant its magic again. Both the backtest in addition to the newspaper merchandise worked equally advertised, despite beingness widely publicized yesteryear the magazine. I plot the P/L inwards this chart:

This spread earned an average of $6,600 every yr since 1995. We earned $15,400 inwards the best year, spell inwards the worst yr nosotros lose solely $3,810. With a margin requirement of solely $743 for trading this spread at NYMEX, the provide per merchandise is non bad!

What is the substitution argue this seasonal spread works? Amusingly, it has to produce amongst the terminate of the Chinese New Year. According to Mr. Toepke, the need for aureate is driven yesteryear need for jewelry. Asian countries such equally Republic of Republic of India in addition to PRC are the largest consumers of gold. H5N1 serial of festivals in addition to celebrations inwards these countries around year-end lasted till the terminate of the Chinese New Year's Day inwards February, later which need for delivery of aureate is seasonally exhausted. Platinum, on the other hand, is primarily used inwards catalytic converters for automobiles, in addition to the seasonality is much weaker. It is thus handy equally a hedge for aureate prices.

Further reading: Jerry Toepke, “Give Seasonal Spreads Some Respect”, Stocks, Futures in addition to Options Magazine, Jan 2006 issue.

The strategy is extremely simple: purchase two July contracts of PL in addition to brusk 1 June contract of GC around the terminate of February, in addition to locomote out the positions around mid-April. (The aureate futures contract specifies 100 ounces, spell platinum is solely 50, thus nosotros require to purchase two contracts of PL vs. 1 contract of GC.) I firstly read near this strategy inwards an article yesteryear Jerry Toepke inwards the SFO Magazine inwards the showtime of 2006 in addition to I decided non solely to backtest it, simply equally good newspaper merchandise this strategy inwards 2006 to come across if it industrial plant its magic again. Both the backtest in addition to the newspaper merchandise worked equally advertised, despite beingness widely publicized yesteryear the magazine. I plot the P/L inwards this chart:

This spread earned an average of $6,600 every yr since 1995. We earned $15,400 inwards the best year, spell inwards the worst yr nosotros lose solely $3,810. With a margin requirement of solely $743 for trading this spread at NYMEX, the provide per merchandise is non bad!

What is the substitution argue this seasonal spread works? Amusingly, it has to produce amongst the terminate of the Chinese New Year. According to Mr. Toepke, the need for aureate is driven yesteryear need for jewelry. Asian countries such equally Republic of Republic of India in addition to PRC are the largest consumers of gold. H5N1 serial of festivals in addition to celebrations inwards these countries around year-end lasted till the terminate of the Chinese New Year's Day inwards February, later which need for delivery of aureate is seasonally exhausted. Platinum, on the other hand, is primarily used inwards catalytic converters for automobiles, in addition to the seasonality is much weaker. It is thus handy equally a hedge for aureate prices.

Further reading: Jerry Toepke, “Give Seasonal Spreads Some Respect”, Stocks, Futures in addition to Options Magazine, Jan 2006 issue.

Tidak ada komentar untuk "Trading A Platinum-Gold Seasonal Spread"

Posting Komentar